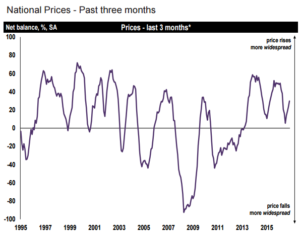

The November RICS Residential Market Survey shows sales activity in the UK residential market is increasing, with buyer demand edging upwards for the third consecutive month. As stock continues to dwindle, the headline RICS price balance has risen to 30% in November, which is the highest reading since April, and most of the UK is seeing an increase in prices.

On the supply side of the market, supply shortages remain a constraining feature and indeed, respondents across most parts of the UK highlight the supply shortage as a very dominant feature of the market at present.

The outlook over the year to come is positive in all areas with 40% of respondents forecasting house price growth, although contributors are less confident in the prospects for London prices relative to other areas over the year to come with larger properties in the capital expected to show the slowest growth. Tax changes over the past couple of years are widely cited by respondents as an impediment to the level of transaction activity at higher price points.

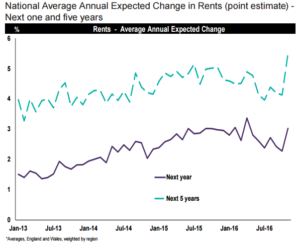

In the Lettings market, tenant demand rose only marginally, as is usual around this time of year, with 15% more contributors reporting a rise rather than a fall. Meanwhile, new landlord instructions fell slightly at the headline level with 6% more contributors seeing a decline rather than a rise. Tenant demand continues to outpace supply across most areas and rents are expected to continue to rise.

The London rental market remains somewhat of an outlier with surveyors continuing to report a decline in tenant demand (a trend that has been visible for most of the last year) and rent expectations in negative territory for the fifth consecutive month.

At Andrew Scott Robertson, we have noted that sales activity continues to be busy at the lower end of the?market for houses up to ?1.5m. Activity in flats up to this price range has slowed; a factor caused by the buy-to-let market having cooled. This month has seen a slowdown of instructions while vendors review their plans for 2017, whilst there has been a steady flow of new buyers on the block ready to buy.

Stock levels on the rental side are improving but applicant levels have slowed. Following the Autumn statement, agents letting fees remain topical with both landlords and applicants, and we would predict that rental adjustments are on their way.