Andrew Scott Robertson, Chartered Surveyors & Estate Agents, Wimbledon

General News

Shortage of supply in both the lettings and sales segments continue to present a huge challenge for the market, according to the January 2017 RICS UK Residential Market Survey

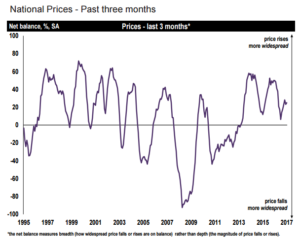

Starting with the sales market, at a national level, transaction volumes and enquiries have both seen relatively little change over the month. At Andrew Scott Robertson, we had a very busy start to the year with a greater number of applicant registrations and valuations than last year.

Even in light of stamp duty costs the prevailing demand and lack of supply of houses below ?1.8M is attracting competition between buyers. Above this level but more so over ?2M ?it is a different picture with some agents over-valuing. This has left vendors confused, resulting in very few offers being made for this reason alone.

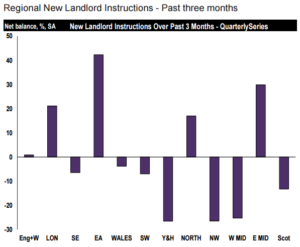

With regards to the rental market, again a shortage of supply remains a challenge and the lack of listings coming to the lettings market may become an even greater issue ahead, with changes to Stamp Duty, alongside scheduled cuts to mortgage interest tax relief, both seen as important factors diminishing the attractiveness of buy-to-let as an investment. That said, during the three months to January, tenant demand continued to increase at the national level, albeit modestly. This imbalance between supply and demand is expected to squeeze rents higher. Over the next five years, rental projections point to a cumulative increase of just over 25%.

At a local level, we had a very good start to 2017 with activity levels improving on all fronts. Tenants are negotiating hard on rental prices but we have noted resistance by landlords to accept offers and this is slowing the number of lettings transactions possible.

Posted in ASR News