We are pleased to report that Ian Ailes FRICS, Commercial Director for Andrew Scott Robertson was featured in the recent RICS Q3 2017 UK Commercial Property Market Survey.

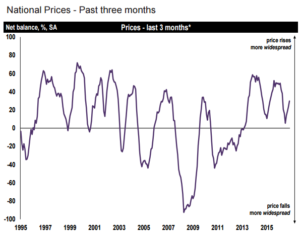

The RICS survey is widely recognised as one of the best indicators of developments in the UK commercial property occupier and investor markets. The results of the Q3 survey show that both investor and occupier demand edged up during Q3 for UK commercial property, but there is still a significant difference between sectors with industrial clearly outperforming.

Survey in brief

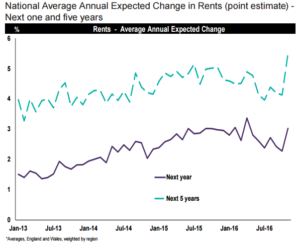

- Rent expectations upbeat for industrial space, but flat for offices and negative for retail

- Pick-up in both domestic and foreign investment demand at the national level

- London continues to display more cautious sentiment with 73% of respondents in Central London sensing the market to be in some stage of a downturn.

The view from ASR

Ian Ailes comments in the report ?The market is suffering from a negative view and there is nothing on the horizon likely to improve perception. The next event is the Chancellor?s autumn statement but we need something positive in it to incentivise businesses ie less taxation which will generate a larger tax collection. Money is cheap but no one wants to borrow if rates may rise. The Bank of England needs to address this. Threats of interest rate rises are over recessionary. Domestic SDLT needs to be reduced or made fairer to stimulate sales and so new builds from which the economy takes its lead.?

The view from RICS

The feedback to the Q3 survey reflects some of the broader macro issues, with the underlying momentum in the occupier market a little firmer further away from the capital. This is also mirrored in valuation concerns with around two thirds of respondents viewing the London market as being dear.

A key issue going forward will be how the market responds to the likely first interest rate rise in a decade next month. Given that expectations are only for a modest tightening in policy, the likelihood is that it will be able the weather the shift in the mood music. But this remains a potential challenge if rates go up more than is currently anticipated.

To read the survey in full click here.